Jawaharlal Nehru

Long years ago we made a tryst with destiny,

and now the time comes when we shall redeem our pledge,

not wholly or in full measure, but very substantially.

At the stroke of the midnight hour, when the world sleeps,

India will awake to life and freedom…….

—

After a hiatus of three months, I am updating my blog on the auspicious day of our independence. Vande Mataram.

—

The Wholesale Price Index (WPI) never fails to surprise. While my flatmate, Supari Gupta, cribs about increasing dal, moong and other prices (sugar prices are on such steroids that the fund managers of Smart Portfolio have lined up a battery of sugar stocks to invest in, from Andhra Sugar to Sakhti Sugar and god knows what not sugar), the WPI inflation continues to plunge deeper and deeper into negative territory. So much so, that commentators have now started criticizing the index as far fetched from ground realities and faulty. There is also a clamor to shift focus to Consumer Price Index (CPI) inflation.

WPI inflation for the week ended 2nd Aug 2009 stood at -1.74 per cent, down from -1.58 per cent in the preceding week. This was surprising as we are witnessing rising food prices on the fear of a drought. However, a closer analysis would tell us that the above figures can be explained and the wholesale price index is not so misleading as it is made out to be.

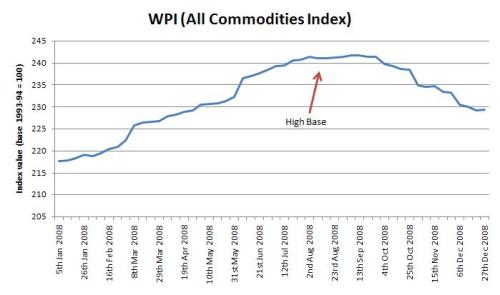

As the graph above suggests, the WPI inflation for food articles does capture the surge in food prices neatly. The WPI inflation for all commodities shows a fall because of two reasons- the weighting scheme and the high base effect. Primary articles gets a weight of 22.02 per cent, fuel, power, lights and lubricants 14.23 per cent and manufactured products 63.75 per cent. Thus, even with increasing food prices, a generally cooling manufacturing prices makes the overall inflation benign.

Another reason for the apparent contradiction of falling WPI numbers in the face of increasing prices is the high base effect. WPI inflation is constructed on a year on year basis. If a basket of goods costs Rs. 100 on 1st Aug 2008, and the same basket of goods costs Rs. 102 on 1st Aug 2009, then inflation on 1st Aug 2009 would be computed as 2 per cent, i.e., inflation is measured relative to prices existing in the preceding year. Thus, if prices was unusually higher for some weeks in the previous year, the inflation figures for the same weeks this year would be lower. This is exactly what has happened to the WPI inflation figures for the the week ended 2nd Aug 2009, as the graph below would testify. The wholesale price index showed a huge uptrend in August the previous year, contributing to the high base effect.

Because of the above factors, the latest WPI inflation figures may seem surprising, but they are certainly not reasons to doubt the ability of the index to capture price changes in the Indian economy.

Though I do not disagree with your figures, I would still like to know where you are getting the statistics from.

By: AJ on August 15, 2009

at 7:46 am

Hello… I got the statistics from Office of the Economic Advisor, Ministry of Commerce and Industry.. You can access the same at http://eaindustry.nic.in/

By: Ravi Saraogi on August 15, 2009

at 1:31 pm